rolla226:findingsharon:serial-cereal-eater:stfuconservatives:McDonald’s partnered with Visa in a lau

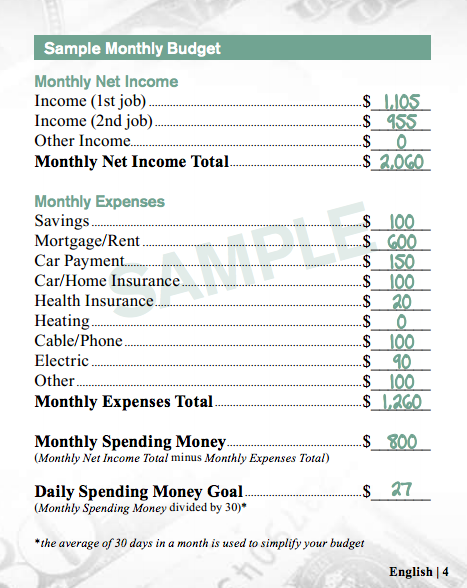

rolla226:findingsharon:serial-cereal-eater:stfuconservatives:McDonald’s partnered with Visa in a laughable attempt to tell minimum-wage workers how to make a budget. Here’s what they suggested. You are reading this correctly: They’re telling their workers they essentially HAVE to take on a second job to live, they think minimum-wage part-time employees can get health insurance for $20 a month, and they don’t think anyone needs to keep the heat on.Hmm. There’s a McDonald’s near my house. Ostensibly the workers live nearby. So let’s use my budget and see how they stack up.Savings… I’ll be game and pretend that a minimum-wage worker can save $100 a month, sure.Monthly Rent… $800 for my halfCar Payment… $250/month. But I bought that (used!) car after I started at a job that paid well above minimum wage (one of those mysterious “careers" us millenials keep hearing about). I know a friend who bought a shitty Toyota and paid $110/month for his car payment, so that’s the number I’ll use for this example.Car/Home Insurance… $140/month for car, $25/month for renter’s insuranceHealth Insurance… about $50/month (my health insurance is heavily subsidized through my employer, obviously, and I’m a full-time salaried employee. And it’s still not $20!!!)Heating… $4-15, depending on the season. I live in Southern California, so the heat only needs to be a few weeks out of the year, but we still pay a gas bill every month from using the stove and oven.Cable, internet, phone… $240/monthElectric… $50/month (More when it’s hot out and I have to turn to A/C on)Here are some items that are NOT mentioned in the budget (I guess they’re all “other"?), but come up pretty regularly for most of us humans:Groceries… $300/monthHealth expenses other than insurance (co-pays, prescriptions, OTC drugs)… $70/monthGasoline… $80/month (lots of minimum-wage workers use public transit, but if this budget is making me account for car payments and insurance I’m not taking the fucking bus)The ThinkProgress article points out that they don’t budget for clothing. When you’re poor, you don’t really buy clothing on a monthly basis. I’ll put $25 in the budget for “wardrobe maintenance" - buying a new shirt for work, replacing worn-out sneakers, etc.So let’s see.Aaaand we come to… $1,920. If I’m making $2,060 at my two part-time jobs that are magically lenient enough to make my schedule and hours consistent and never overlap with one another, I have $140 left per month for “spending money,“ not $800. So, $35 a week. That gives me a daily spending allowance of $4.60. A single illness or car repair would take down my entire budget.This has been a long exercise in saying: Fuck you, McDonald’s.wow i love when rich people tell poor people what they should be able to afford.cool story, assholes.what i want to know is where are people living that their rent is only $800 & their car payments are only $150. where is this fantasy land???? (also this whole thing is completely ridiculous)My mortgage is only $700 a month (including home insurance and taxes) and it’s a decent size house and even before when we were renting apartments we never paid over $550. $800+ seems ridiculously high to me.where do you live and are they hiring? -- source link

Tumblr Blog : stfuconservatives.tumblr.com

#becausefuthatswhy