Georgian Era Stock Market Crash — The South Sea Bubble of 1720In 1711 a long war between Brita

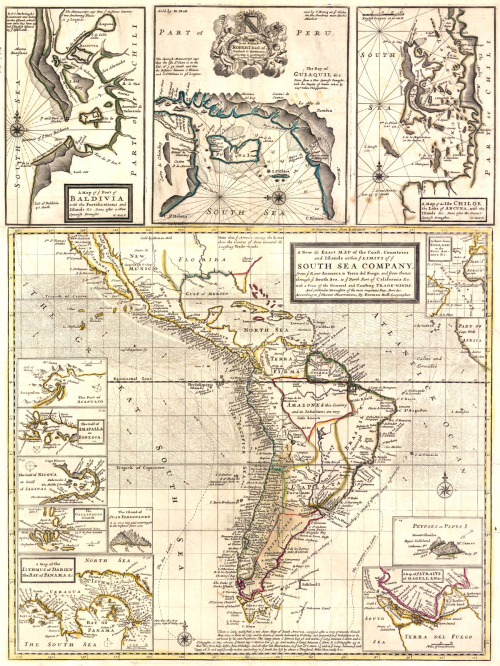

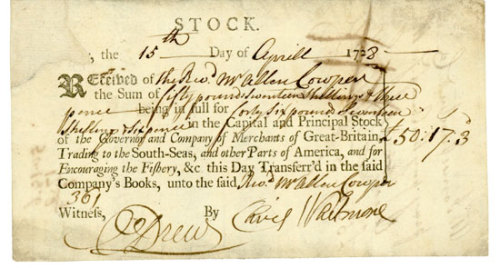

Georgian Era Stock Market Crash — The South Sea Bubble of 1720In 1711 a long war between Britain and Spain ended, leaving the British Parliament 10 million pounds in debt. In order to pay off this debt the British government became involved in series of speculative deals in order to raise money to pay off the debt. One such opportunity was the “South Sea Company”. A joint stock company founded by various bigwigs in the Bank of England, the business was bolstered by investments from Parliament with 6% interest. However, most of the company’s funding was through private investors, who received shares of ownership (stock) in the company. What made the company unique and added to its perceived profitability was that it was granted exclusive trade with South America. Dominated by Spain, it was expected that much sought after British goods (wool, fleece, slaves) would bring in a vast wealth of South American gold and silver.The allure of investing in the one company who traded wealth of the Spanish Main caused hordes of investors to purchase stock in the company with a get rich quick attitude. The South Sea Company itself furthered its image of a super wealthy trading company by building large lavish offices and headquarters. Corrupt managers of the company even hyped the value of the company’s stock further, drawing in mobs of investors egged on by illusions of wealth and grandeur. The company even started the rumor that Spain had granted complete access to South American ports. However, there was one secret of the South Sea Company that threatened to completely derail their gravy train; the Spanish government only permitted the company to send three merchant ships to South America a year. This was by no means a wealth of profit. In essence the South Seas Company made most of their money by selling shares of stock rather than selling goods to South America. The South Seas Company had become a large Georgian era ponzi scheme.A ponzi scheme is a fraudulent investment scheme in which the money of new investors is used to pay back the investments of old investors. The company does not produce any profit of their own but merely acts as a confidence man, drawing in more investors to support an ever growing scheme. The most infamous ponzi scheme in history was conducted by Bernie Madoff, a stock broker whose scheme collapsed in 2008, bilking investors out of a record $65 billion. The fate of any ponzi scheme is eventual collapse. So too was the fate of the South Sea Company. As more people invested in the company and with little incoming profit, the company found itself having to pay off those investors with the investments of new investors. In order to pay off new investors, the company had to recruit investments from even more new investors. Thus in order to survive the South Sea Company had to recruit more and more investors to support its ever growing, massively bloated bubble. Mathematically supporting the company’s ponzi scheme would become impossible as the number of investors needed to support the scheme grows exponentially. Eventually the South Sea Company would need the investments of every man, woman, and child in the British Empire to continue feeding its scheme. It was only a matter of time when the South Sea Company ran out of people willing to invest and the bubble would burst. In 1718 war was once again declared between Spain and Britain. As a result Spain cut off all trade with Britain. The South Seas bubble should have burst right then and there, but the company still had some charisma to draw in more investors and keep the scheme going. By 1720 however, it became clear among the managers of the company that the gig was up. They immediately sold their shares of stock, collecting huge fortunes for themselves but leaving their investors high and dry. This triggered a panic of selling. Overnight the value of South Seas stock became worthless as sellers could not find buyers who would purchase their now meaningless pieces of paper. At best stockholders could only hope to sell their stocks for pennies on the pound. Thousands saw their financial prospects and visions of grandeur ruined. The most intelligent man of his age, Isaac Newton, commented on the bubble, “I can calculate the motion of the heavenly bodies, but not the madness of people”. Newton himself lost a whopping 20,000 pounds in the scheme. Another bilked investor, Jonathan Swift, was inspired by the bubble to write the novel Gulliver’s Travels as a criticism of British society. Britain itself was thrown into economic chaos as banks closed down and creditors stopped lending. The British Parliament, the initial investor in the company, was thrown further into debt as it had to act as lender of last resort in order to keep credit markets running. The effects of the bubble would last generations. -- source link

Tumblr Blog : peashooter85.tumblr.com

#history#economics#money#scam#ponzi scheme#investing#isaac newton#jonathan swift#finance#finances#britain#south america#spain#stock#stock market#financial bubble#economic bubble