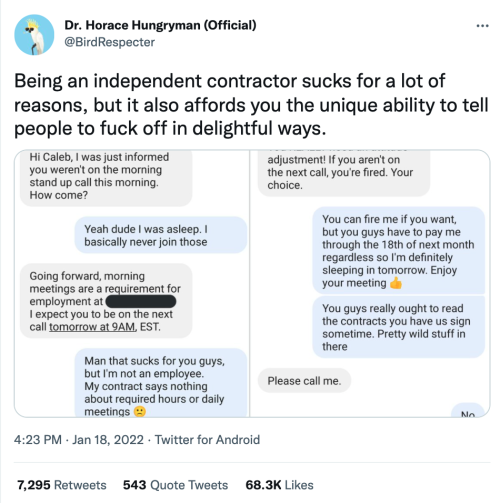

trekwiz:trekwiz: Ok, but if you’re an independent contractor in the US and this happens? Find

trekwiz:trekwiz: Ok, but if you’re an independent contractor in the US and this happens? Find a lawyer, because you might have just gotten a huge payday. Your position was just referred to as employment. Independent contractors do not have employers; they do not have employment. Congrats, your contact at this company just provided evidence that you were illegally missclassified.This contact is claiming that you have set hours you’re obligated to fulfill. Unless a work task can only be done at a set time for practical reasons (i.e. you’re an audio freelancer paid to support a live event that occurs at a particular time and requires a certain amount of pre-show setup), a company cannot set an independent contractor’s work hours. This is further evidence that you were missclassified.The whole exchange establishes that the company is interpreting an employer-employee relationship rather than expecting a service. Discipline and potential for firing (you cannot fire an independent contractor; no longer purchasing their service is not equivalent) establish that this person views themselves as a manager. Independent contractors cannot have managers. This one text exchange could: Get you back pay for the full duration you’ve worked there, to bring you up to the compensation that an employee would have gottenGet you back compensation for lost benefits that an employee would have gottenGet you back pay for the additional self-employment taxes the company should have coveredGet the company to pay back taxes to the governmentGet the company to hire everyone who performed a similar role, or face further penalties and finesA win would encourage the rest of their missclassified workers to sue for the same, or give them leverage to demand a better dealIf the company is going to screw you over like that, may as well make them pay for it. Since this is getting a lot of reblogs, here’s a federal source that can help you determine if you’re illegally classified as a contractor: Misclassification of Employees as Independent Contractors | U.S. Department of LaborYou can also file a form with the IRS to force the company to correct your classification (assuming you meet the criteria), without necessarily having to sue: Independent Contractor (Self-Employed) or Employee? | Internal Revenue ServiceKeep in mind that this is just federal. Most states also prohibit missclassification as an independent contractor; and even if states have more lenient rules, companies still have to comply with this federal law. The rules have largely been bipartisan and existed for decades, so they’re common. States also have an interest in having regulations about missclassification: it’s a significant loss of tax revenue. Your self employment tax does not fully equal what a company would have paid for you in payroll taxes. A lawyer can help point you in the right direction if a company is currently missclassifying you. -- source link

Tumblr Blog : dispatchesfromtheclasswar.tumblr.com

#employment#independent contractor#lawyer#business ref#protection